My Story: The Battle With Sid

My name is Grant Sudduth and this is my blog.

I started affiliate marketing and my original blog in 2015. I’ve learned a lot between then and now. After reflecting back on the last 7 years, I’ve decided to start this new website and hopefully, all I’ve learned will shine.

But, for me, it wasn’t an easy road. There were lots, and I mean lots of ups and downs, (leaning on the downs side)and my biggest problem through it all was Sid.

Sid and I have been friends for a long time. And to be honest, he did everything in his power to keep me from being successful my whole life. He still hides in the shadows, waiting for his next opportunity to pull me down.

Sid is my pet name for Self-Doubt. He has haunted me as far back as I can remember. Luckily, I’ve figured out how to get the best of him…at least most of the time. Otherwise, I wouldn’t be writing this blog right now. But, let’s go back to the start.

In the beginning:

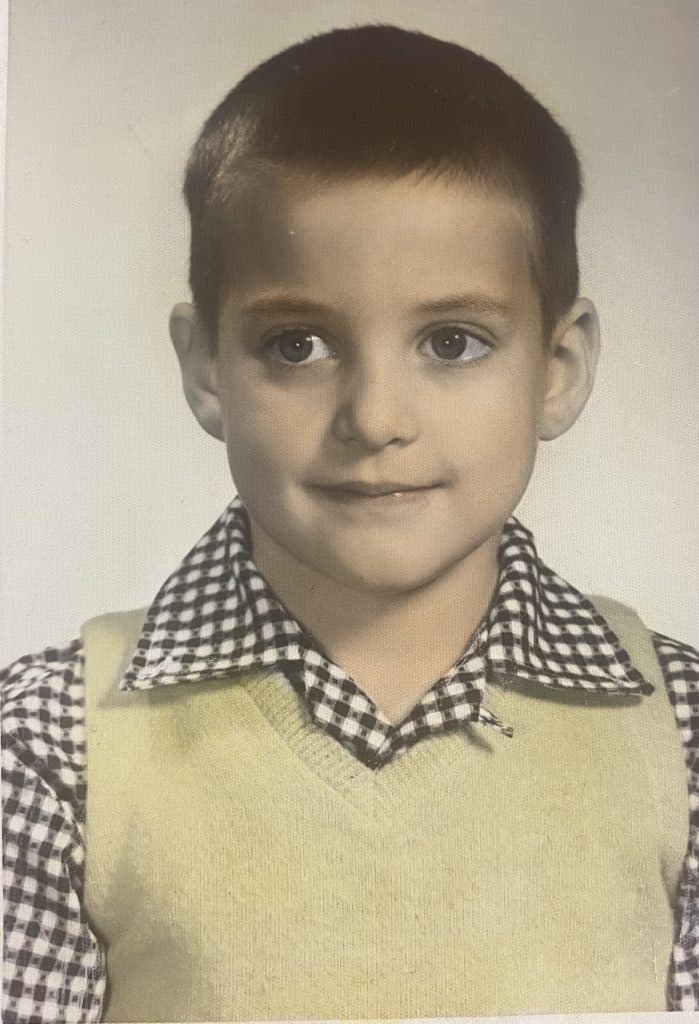

I was born in the grand city of Frankfort, Kentucky in 1953. Jeez was it really that long ago? I was the first of three. After me, came my brother and then a sister. We were all three years apart. My parents didn’t have all that much money, but, they made sure we were taken care of.

My dad worked in a factory and my mother was the typical housewife. That was the thing back then. He gave her so much a week to get the groceries with and the rest went to the bills. My dad worked hard for 35 years until he retired and that is how I was “brought up”.

Get a good education, get a job, work hard all your life, retire, and enjoy the rest of your life.

It took me quite a few years, too many, really, to realize by the time you retire, you may not be in good enough shape to enjoy the rest of your life. And there may not be much left of “the rest of your life”!

Anyway, in elementary school, I always did really well in the three “R’s”. Readin, ‘Ritin, and ‘rithmetic, and I guess as a reward I was given a piano at the age of eight years old when I started wanting to learn to play. I really enjoyed the weekly trips into town for my thirty-minute piano lesson. (How my parents could afford that, I’ve never asked) But, I enjoyed it until…

The piano recital.

Once a year, my piano teacher would present a piano recital of all her students to show off what they had learned that past year.

That’s when I met Sid. I was ten years old. He told me there was no way I’d be able to get up in front of all those people and play a Mozart piece and get through it. And from memory on top of that! I promptly let my parents know it wasn’t going to happen.

They promptly let me know if it didn’t happen then there would be no more piano lessons.

I wrestled with Sid nightly for a full month before the recital. But, I truly loved learning to play the piano and I wasn’t going to bale out.

Of course, the recital went without a hitch. And the following nine years of recitals all went without a hitch, also. But, I fought with Sid every year. He always told me I couldn’t do it. I should just quit.

But, I didn’t.

For a long time, I had hoped that I’d get really good at the piano. Enough to where I’d be famous. Make a lot of money and be able to retire by the time I was 30. My dad said that was all hogwash and I needed to get a “real job”.

Sid said the same thing. Get a job. Work hard.

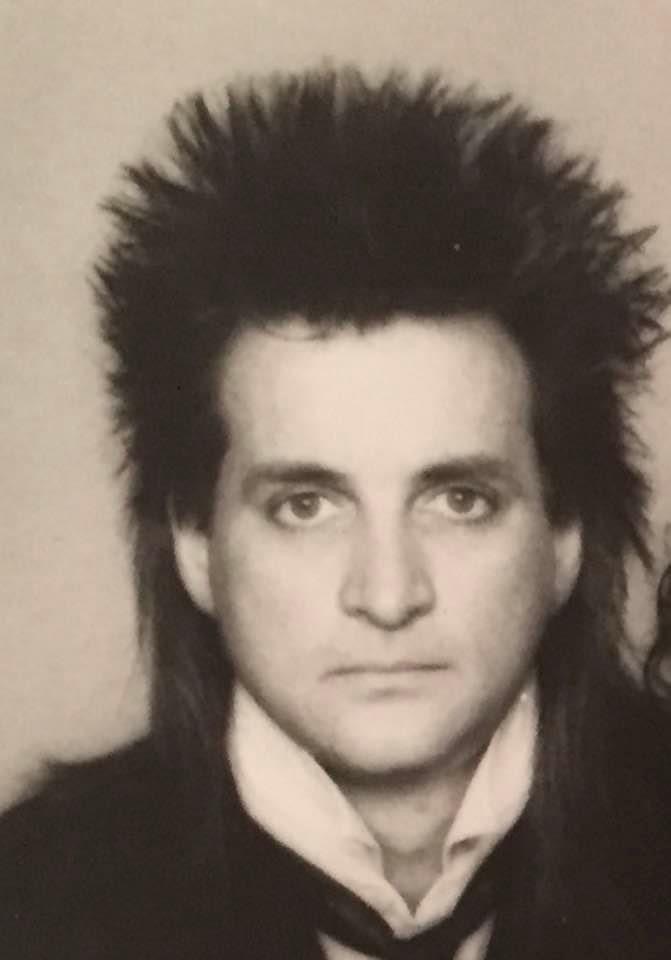

Well, I was able to make a living my whole life by playing the piano. But, it was a struggle with Sid at every turn. I would play for weddings and couldn’t sleep for the whole week leading up to the wedding with Sid in my head. What if you mess up the march? Can you play that special song they requested? Do you even remember the music for the exit? Even on the road in the rock bands, I’d be sick to my stomach from Sid before going on stage.

But, I’d win the fight with Sid in the end and get the job done.

A Different Life In The ’90s

The 90s rolled around and after traveling on the road with rock and roll bands for twenty years, I got married and had a son and daughter.

Life changed quite a bit. But Sid didn’t.

He got worse.

What the hell are you thinking? You don’t know how to raise a family. You don’t know how to provide for a family.

And I’ll admit, it was scary. I was already 35 and just getting around to starting a family much less taking care of the small farm we had bought.

Music moved into a part-time position and house rehabbing for folks and the bank became my full-time job. And Sid went into full gear. “Thought you were going to be retired by 30? You’ll be lucky to retire by 80!” And the bad part is I let him convince me of that. I was 35 and all I had to show for the last 20 years was a farm mortgage and other than that, not really a pot to piss in. At least not compared to what I thought I would have by then.

We were living week to week. I tried to ignore Sid and figure out a way. A way to still get ahead without working my fingers to the bone and retiring and dying. And I didn’t have a penny saved for retirement.

Real estate. It came to me during a sleepless night. I’d seen an infomercial about 3 a.m. and it was Dean Graziosi, believe it or not, and he was peddling his new book and course on investing in real estate and flipping properties or renting them. THAT was going to be my retirement and I knew if I did it right, I could still retire at least by late 50. I told Sid to shut up and I went to work on making it happen.

The Real Estate Years

Luck had it, I had made friends with a millionaire friend of my dad’s. (My dad sold scrap metal to him from the factory dad worked for) I had also played music at some of his house parties off and on.

I knew he had made his fortune in real estate and probably owned half of Frankfort. So, I went to him, told him my intentions, and asked if he would finance the first rental house I wanted to buy.

He agreed. In fact, he’d just give me a blank check to take to the auctions to use if I ended up getting the house. Then his company would set up a mortgage for me. Sweet. Okay, he loaned me the money to buy the houses, but, I still needed money to fix them up. I went to a local bank and offered my farm as collateral and asked for a $50,000 home equity line of credit. With the combination of that and the fact it was for income-producing properties, they gave me the loan.

I worked hard over the next few years and built my little empire into eight rental properties. One mistake, though. Instead of buying one, then getting it rehabbed and rented before buying the next, I bought houses whenever a deal popped up. Now, I was suddenly paying mortgages on eight rentals, but only had four finished and rented. But, things were going otherwise as planned and if I stuck to it, by the time I wanted to retire, (which had now been pushed to 60 years old) the houses would be paid for with $700-$1000 a month coming in from them. And best of all, I had silenced Sid pretty well.

But all fairy tales usually have a twist in the plot. Mine was no exception. One cold winter morning in 2009, my dream world and all the big plans crumbled.

My private investor/mortgage holder unexpectantly passed away. I met with his attorneys and they informed me that the estate would not carry the mortgages on the properties and that I needed to pay them all off. If not, they would have to be signed over to the estate. The bad thing about this was, I was an ex-musician with no credit, plus, the real estate world had just had their big catastrophe, and banks weren’t even making real estate loans to the big guys in the business, much less to me.

After thirty days of desperate phone calls and door-knocking, I met with the estate attorney and signed them all back over to them.

My retirement was gone. All of it. And on top of that, another twist appeared in this story. My home equity loan was an adjustable-rate mortgage and was renewable every five years and had just come up for renewal. The loan officer informed me that since I didn’t have the income-producing properties anymore, my loan was not going to be renewed and it needed to be paid off or they would repossess my farm.

Luckily, someone had been wanting to buy the farm and I was able to sell to them rather than lose it. However, I had to take about $30,000 less than I could’ve under normal circumstances and just had enough to pay off the first and second mortgages and a couple of small debts I had, with no money left over.

Then my wife asked for a divorce after 21 years of marriage. Although it wasn’t because of the surrounding events, the divorce had been brewing over the last couple of years, and the timing made it that much harder.

In one quick sweep, I had lost my home, retirement, and marriage.

I was nearly 57 years old.

Sid was running rampant.

The Limbo Years

Do you know what it’s like to move back in with your parents at 57 years old? Believe me, you don’t want to know. I highly advise against it. I love my parents, don’t get me wrong, but, we had all gotten set in our ways pretty solidly by now and no one was about to compromise. Plus, I got to hear from my dad each morning that if I had had a “real job”, I’d have been close to retirement with no worries.

Sid was having a feast.

And he was winning now, every step of the way. I had no will left to fight back. Sid was right. I should have listened. I should have worked with the state government instead of going on the road playing rock and roll music and being self-employed my whole life. I could have actually been retired by now. One of my best friends retired at 48 years old from a state government job. Yes, what the hell was I thinking?

I was in a funk for quite a while. It was almost like a total haze. Surreal. Looking back, however, I’m sure God had a good reason and if there was such a thing as a good time for this to happen, it was now. My dad’s health had been failing and I was at least able to help out a lot around his “gentleman’s farm” and help my mother out around the house.

I felt pretty much at rock bottom. Sid was just shaking his head. “I told you so”, he whispered in my head continuously. I didn’t dare think about trying anything else on my own. I’d just fail again. So, after two years of self-pity, I was approached by a local bank if I would rehab the repossessed houses they had obtained during the big crash so they could have better luck at selling them.

Getting Back On Track

Two and a half years into the rehabbing job, I started realizing that manual labor was just a bit more demanding than it was in previous years. Lifting drywall, roofing, floor installation, etc wasn’t the type of job that you want to be doing going into your 60s.

I also realized I didn’t want to die a broke, old lonely man. I started looking on the internet to see just what was out there that might not be so hard on the body and maybe I could work from a desk at home. I had heard about this but always figured it was a scam. Sid started slapping me on the side of the head. I did my best to ignore him.

At the start of 2013, I met someone that turned my life around. She supported all that I did and encouraged me and helped me push Sid out of the way. At about the same time, I discovered affiliate marketing.

I researched it and found it wasn’t a scam after all. It was a legit business. You were merely selling services and products for someone else and they paid you a commission. It was the oldest business in the book. The new twist was you could do it from home or wherever you wanted. This, I decided, was going to be my retirement rescue.

Mid-2013 I started a course on affiliate marketing with an authority website and slowly started building my new business. At the end of 2014, my first commission came in. It was from Amazon and for a total of 43 cents. You would have thought it was 43 thousand. lol. I was ecstatic! It was a small confirmation in my mind and to Sid that you could make money on the internet.

Sid said it was just a fluke. And jeez Louise what the hell? 43 cents? Really?

By the spring of 2015, I was starting to bring in more substantial income. At first a few hundred dollars extra a month. ( I was still working 14-hour days with the rehab job). Then I started getting 4 figure months and matching what I was making with my “real job”. In the meantime, I remarried and bought a new home,(one of the rehab houses) and had a good start on rebuilding my retirement along with building up a recurring monthly income with my affiliate marketing.

This coming birthday, I will be entering my 70s. It’s a bit scary. I’m still building my online business. It’s simple but hard work. But not the kind that’s hard on my body. But, I’ve come from living with my parents (second time round), broke and single to blissfully married, a new home, plus, a home in Florida and retirement funds well on the way again.

And that is the main reason for me being here. To show other retirees that may not be blessed with the funds to truly enjoy retirement, or were robbed of their retirement like me, or those that just don’t want to sit idle and have something new and exciting to do. And of course, you don’t have to be retiring to do this, either. There are people from all ages, countries, and walks of life in the communities I am a part of.

But, Lord knows, if I can pull it off, at my age and not having a clue, in the beginning, anyone can. And I’m here to help in any way I can. I can point you to the best that’s out there as far as training, software, mentors, etc, and show you what to avoid and what not to invest in. And along with that, I’ll help make sure you get started correctly with whatever you have taken on. I’m here to make sure you have the very best chance to succeed. I never had someone that would give me a step-by-step explanation of what to exactly do. I’d like to be the one that can help you in that way and keep you from making the same mistakes I did.

And above all…I truly believe you weren’t put on this earth to work hard all your life for someone else’s benefit just to enjoy a few if any, short years of retirement in the end. That is IF your health even allows it.

A word of warning. Sid is always lurking. He’ll never go away. You’ll always be fighting him, but, stick to your guns, don’t listen to him and you’ll succeed at whatever you want.

I Want To Thank You

If you’re here, it means you have some sort of motivation to better yourself, your family, or your life. I appreciate the fact that you’ve read this far and I hope to build a lasting relationship with you. I’m here to help you as a blogger and affiliate marketer and I’m here as a friend. I’ll do my best to respond to every email personally, so I welcome any and all questions, insights, or complaints. I’ll answer them all.

I look forward to this journey together and a fulfilling retirement for us all.

Thank you for reading my story.

I hope you write a story of your own for all to see.